Article: Invoicing

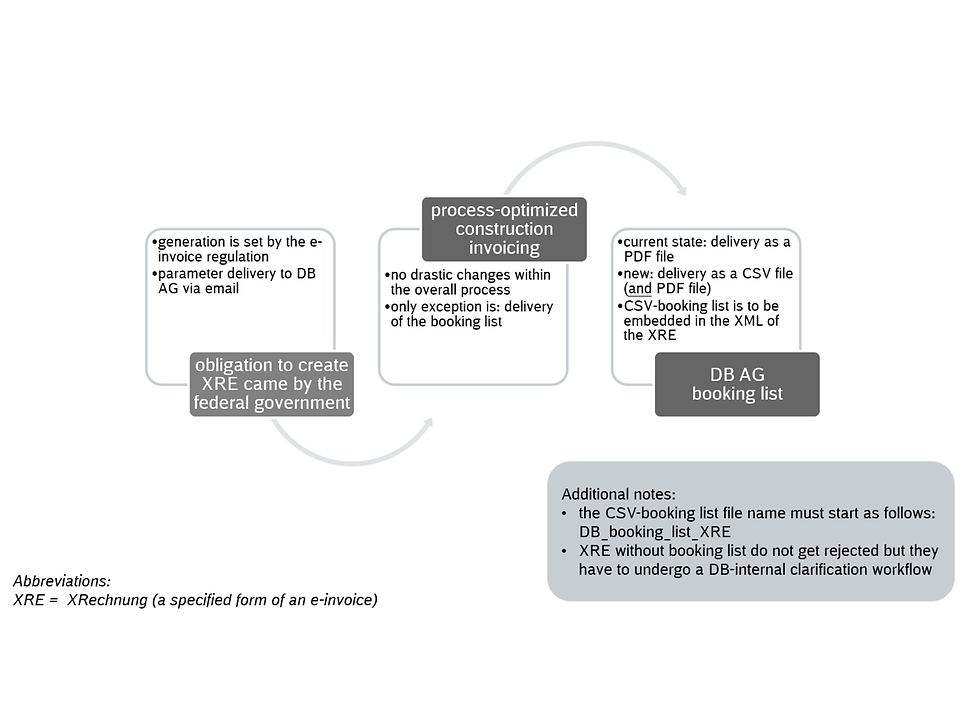

Since 27.11.2020, the e-invoice regulation obliges public clients, such as DB, to demand electronic invoices in XRechnung format from their suppliers.

Regardless of the obligation for public clients, we as Deutsche Bahn would like to and will exclusively accept XRechnung as the preferred electronic invoice format - with a few exceptions.

XRechnungsgenerator is online - Here you can create XRechnung free of charge.

The XRechnungsgenerator is a free offer from DB for creating XRechnung.

You will find the access data and further information in the menu item "XRechnungsgenerator".

Best regardsYour DB SSC Accounting Germany

++++++++++

As a supplier to Deutsche Bahn, you are an important partner for us in ensuring our sustainable success. With the support of our group-wide supplier management, we work with you to ensure high quality standards.

Our goal is to make the invoice approval process as smooth as possible. Invoice data quality is an important aspect of this. To avoid the need for additional clarification and the associated delays in the payment of the invoice amount, we ask you to take the following Deutsche Bahn Group requirements into account when preparing your invoices.